The Republican sweep across the White House and Congress marks the beginning of a new era in fiscal and trade policy, with wide-ranging implications for markets and global dynamics. From tax reform and deregulation to geopolitical tensions and shifting trade alliances, these changes are poised to shape the investment landscape. This commentary delves into the economic, political, and market trends emerging from these developments, offering insights into potential opportunities and strategies to navigate the challenges ahead.

David Feldstein

President & Chief Operating Officer

Vita Financial

Recent Events & How They Affect the Market

Election Results & Policy

The Republican sweep of the White House, Senate, and House is set to transform legislative priorities, focusing on tax reform, deregulation, and reshoring supply chains. Unified control allows the GOP to leverage budget reconciliation for significant fiscal measures like tax cuts and infrastructure spending. Early initiatives will likely bolster key sectors such as energy, defense, and infrastructure, while Senate efforts concentrate on confirming President Trump’s Cabinet and judicial nominees. However, special elections to replace House Republicans joining the administration and slim congressional margins could complicate the timeline, requiring extensive intraparty negotiations.

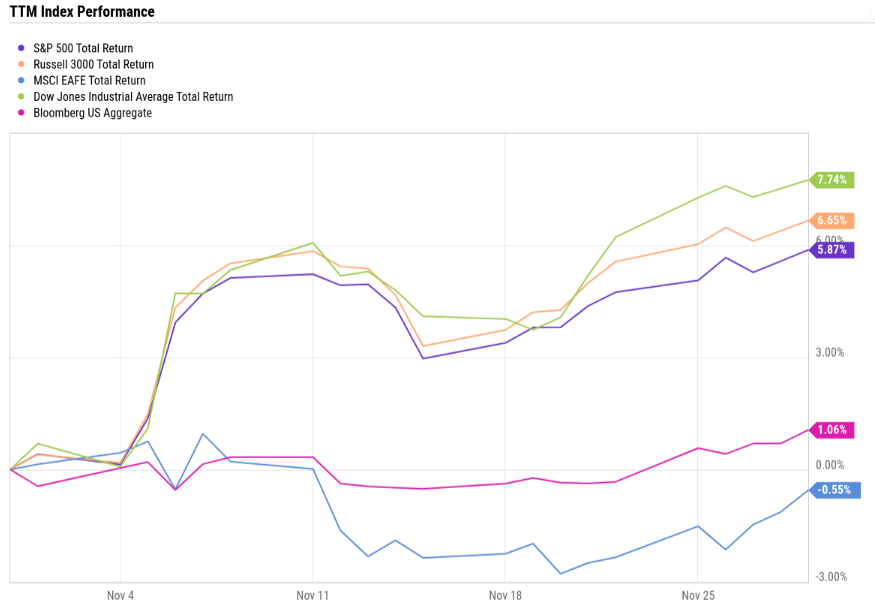

Markets initially rallied on optimism surrounding pro-business policies, but trade protectionism and increased government borrowing to fund initiatives may stoke inflation and raise Treasury yields, posing challenges for fixed-income investors. Looking ahead, navigating this evolving landscape calls for diversification, inflation-resistant strategies, and attention to sector-specific opportunities. The 2026 midterms could disrupt the balance of power, underscoring the need for proactive, flexible financial planning to adapt to potential volatility while leveraging short-term growth opportunities.

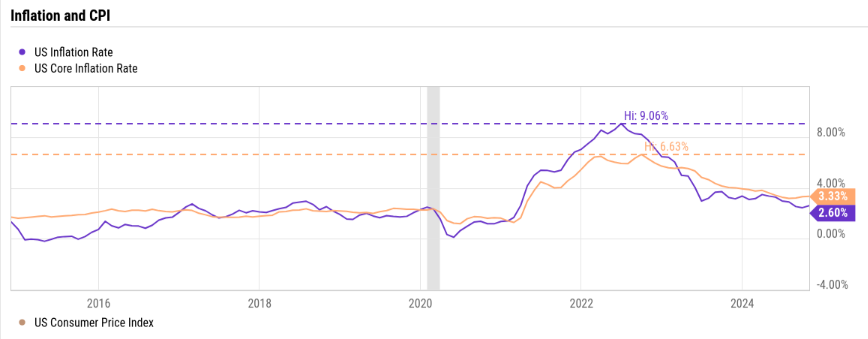

Inflation Monitor

Inflation’s resurgence to 2.6% year-over-year in October 2024 highlights the complexity of the current economic landscape, shaped by structural, policy, and global forces. Persistent housing shortages are driving shelter costs higher, while surging energy prices—fueled by geopolitical tensions, production cuts, and seasonal demand—are escalating transportation and production expenses. Meanwhile, a tight labor market is sustaining wage growth, particularly in healthcare, logistics, and manufacturing, adding upward pressure on prices. Resilient consumer spending and trade policy shifts under the Republican administration, including tariffs and reshoring efforts, are further compounding inflationary pressures by raising production costs and import expenses.

Donald Trump’s administration, with its pro-growth agenda of tax cuts and increased spending on infrastructure and defense, is injecting more money into the economy, likely stimulating demand but also amplifying inflation. Protectionist trade policies, higher tariffs, and supply chain disruptions are expected to raise prices across sectors. Rising food and commodity prices, driven by agricultural disruptions and growing global demand, alongside inflation expectations, are creating feedback loops that sustain pricing pressures. These interwoven factors demand vigilant monitoring of inflation dynamics and readiness for potential market volatility.

Nicholas Benzor

Principal Planner and Chief Executive Officer

Benzor Capital Wealth

US Policies & Their Relation to the Global Market

The Fed Pumps the Brakes

The Friday following the election, the Federal Reserve took an anticipated step by reducing interest rates by an additional 25 basis points. However, the surprise came after the decision during the press conference. Jerome Powell emphasized the Fed’s cautious stance on further rate decreases, signaling a potential shift in monetary policy. While many had anticipated another cut in December, Powell’s remarks highlighted inflationary pressures, which came in slightly higher than expected, prompting a pause in additional rate adjustments. This cautious approach reflects the Fed’s balancing act between managing inflation and supporting economic stability. Current projections suggest a 58% probability that the terminal rate will settle between 3.75% and 4% by the end of 2025, approximately 75 basis points below present levels.

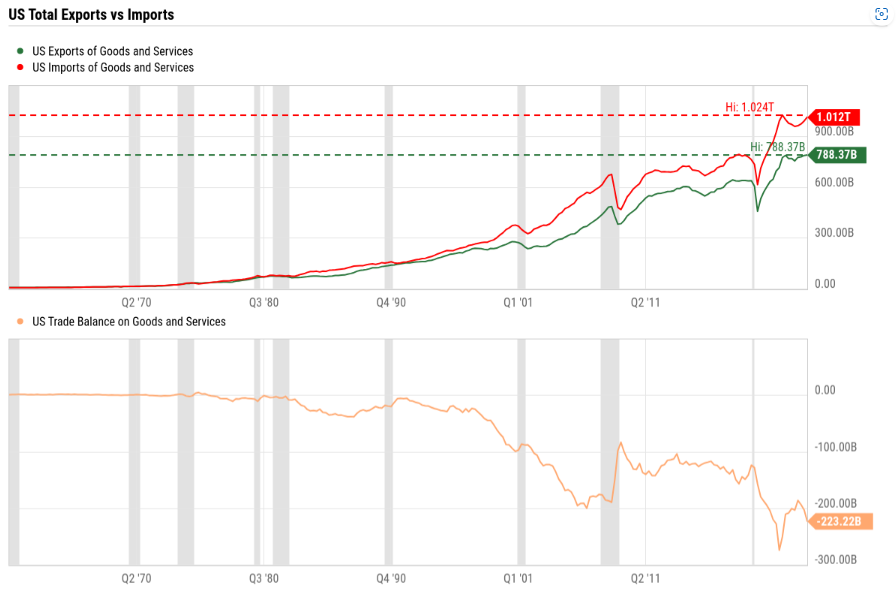

The “T” Word & Global Trade

On the global stage, shifting trade policies and evolving economic alliances are reshaping the international trade landscape, with significant implications for global equities. A new administration in the Oval Office is expected to prioritize trade negotiations, potentially recalibrating existing tariffs and agreements. While the precise strategies remain uncertain, these policies are likely to be used as leverage to address economic imbalances and strategic priorities. Key beneficiaries of this evolving framework could include nations like India, which is positioned to capitalize on increased global trade flows, while China may face headwinds from heightened scrutiny and competitive pressures. As global trade dynamics become more fluid, we remain vigilant, ensuring that client portfolios are aligned to benefit from emerging opportunities while mitigating potential risks.

Geopolitical Tensions Globally

Geopolitical tensions between Russia and Ukraine continue to escalate, drawing increased involvement from outside powers and transforming the conflict into a broader geopolitical contest. Western nations, particularly the United States and European allies, have stepped up military aid and sanctions to bolster Ukraine and pressure Moscow. Simultaneously, countries like China and North Korea are aligning with Russia through economic and military support, respectively, signaling a strategic realignment among authoritarian regimes. North Korea’s provision of ammunition and artillery to Russia underscores its role as a critical ally, intensifying the conflict and heightening global concerns over weapon proliferation and regional instability in East Asia. These dynamics are reverberating through global energy markets, supply chains, and economic stability, necessitating vigilant monitoring of their impacts on financial markets and client portfolios.

Conclusion

The intersection of domestic policy shifts, global trade realignments, and intensifying geopolitical tensions underscores the importance of proactive and adaptable investment strategies. As markets respond to evolving fiscal priorities, inflationary pressures, and shifting Federal Reserve policies, maintaining a well-diversified, resilient portfolio will be critical. By closely monitoring these developments and capitalizing on emerging opportunities, investors can position themselves to mitigate risks and benefit from growth in this dynamic environment.

Key Market Indices

*Market Indices as of 11/29/2024

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult a financial professional for your personal situation.

Past performance does not guarantee future results. Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Graphs provided by YCharts.

Key Market Indices according to Google Finance.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Vita Financial are not affiliated. The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this email in error, please reply to the sender to inform them of this fact. We cannot accept trade orders through email. Important letters, email, or fax messages should be confirmed by calling (678) 250-5099. This email service may not be monitored every day, or after normal business hours.