Markets continued to display heightened volatility in May, with investor sentiment swaying largely in response to evolving trade policy from the White House. While temporary tariff relief from the U.S.–China truce offered a momentary lift to global equities, the broader concern remains: How long will these tariffs remain paused? And more importantly, what will the ripple effects be if they’re reimposed or expanded later this year?

We’re also monitoring for potential external shocks—from trade disruption to geopolitical escalation—that could exacerbate this fragile equilibrium.

Nicholas Benzor

Principal Planner & Chief Executive Officer

Sanskar Raheja

Investment and Financial Planning Intern

Labor Market, Inflation Trends, and Fed Rates:

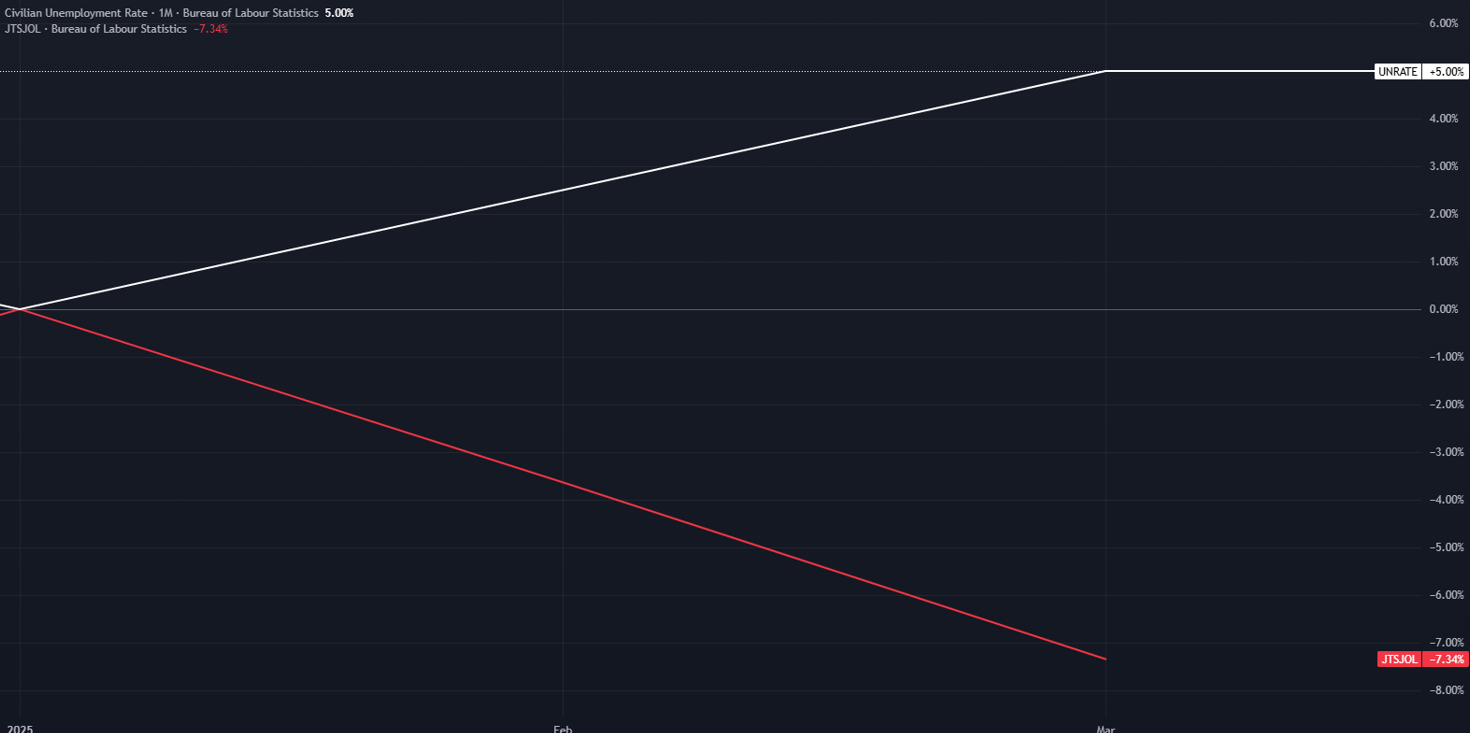

April’s job report, released earlier this month, confirmed a noticeable cooling in hiring momentum. Unemployment remained at 4.2%, unchanged from March, but the pace of job creation slowed more than expected across several key sectors. While not yet alarming, this shift reflects growing employer caution in the face of persistent cost pressures and policy unpredictability.

On the inflation front, the Consumer Price Index (CPI) rose 2.3% year-over-year in April, a slight deceleration from March’s 2.4%. Still, consumer sentiment remains subdued, and inflation expectations are increasingly shaped by uncertainty around tariff impacts and pending tax policy changes.

Looking ahead, the next U.S. jobs report, covering May employment data, is scheduled for release on June 6, 2025. Meanwhile, the next CPI release on June 11 and the FOMC meeting on June 17–18 will be pivotal in determining the Federal Reserve’s path forward. At this juncture, the Fed has held rates steady but maintains a “data-dependent” posture, acknowledging the delicate balance it must strike between curbing inflation and supporting growth. We anticipate a hold again at the next meeting for the FED in the coming weeks, but continue to monitor for unexpected changes that could sway their decisions.

Visual – U.S. Unemployment Rate and Job Openings

Technical Picture:

Markets have entered a holding pattern as investors digest a mix of economic signals and policy uncertainty

The S&P 500 is currently trading around 5,860, having climbed nearly 20% off its early-2025 lows. Despite this impressive rally, the index remains just shy of its previous all-time high of 6,144.15, set in February

Meanwhile, the Dow Jones Industrial Average sits near 41,900, reflecting robust gains year-to-date and relative strength in industrial and defensive names.

Key Technical Levels to Monitor:

- S&P 500

Current: ~5,860

Support: 5,700 (tested and held in mid-May)

Resistance: 6,100 (tested but not broken)

- Dow Jones

Current: ~41,900

Support: 41,000 (tested and held mid-May)

Resistance: 42,800 (not yet tested)

As both indices consolidate near major levels, markets appear to be awaiting the next catalyst. A confirmed breakout or breakdown from these levels will likely determine the next leg of market direction.

Chart – S&P with levels marked

Chart – Dow Jones with levels marked

Chart – S&P 500, Dow Jones, and Nasdaq comparison

Fixed Income & Interest Rates:

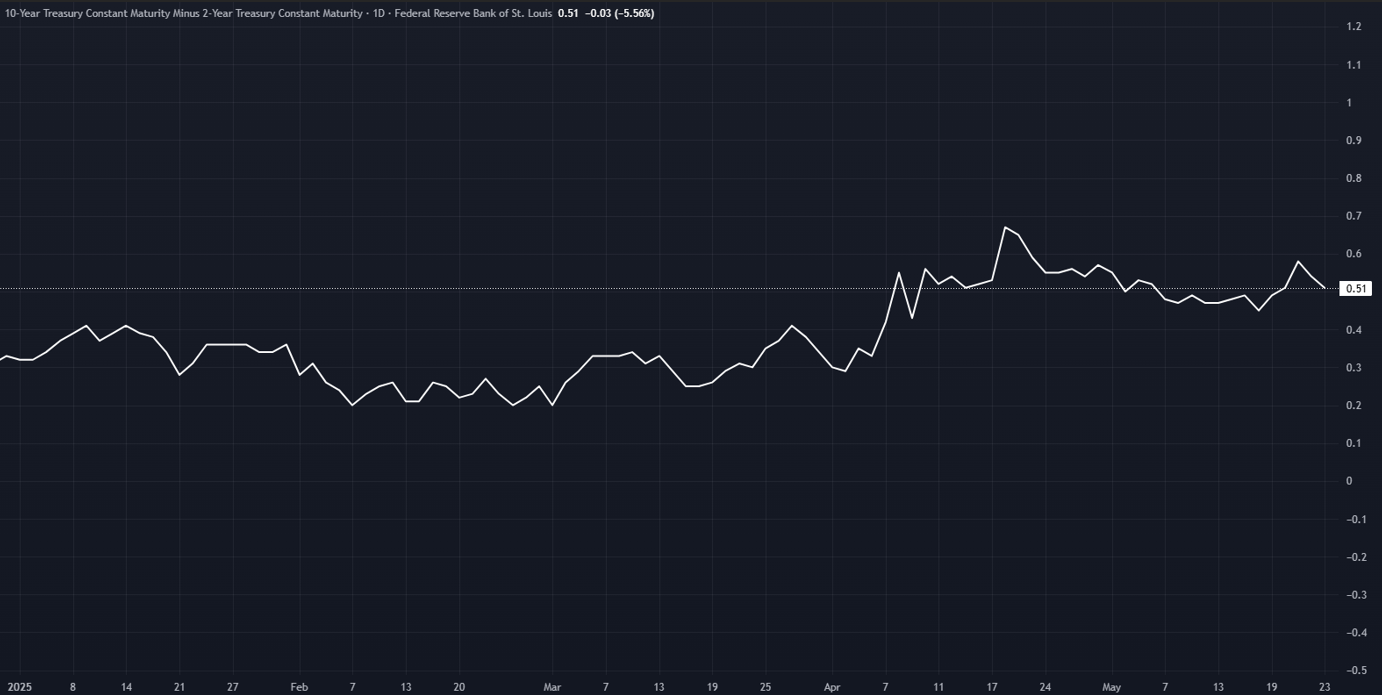

In fixed income, the story continues to be one of elevated yields and rising risk premiums. Treasury markets have reacted to both stubborn inflation data and a growing consensus that the Fed may not cut rates as early or as often as once expected. The 2-Year Treasury yield is at 4.00%, the 10-year Treasury yield has climbed back above 4.5%, and the 30-year touched 5.04%, its highest point since 2023. The steepening of the yield curve, driven by rising long-term rates, is signaling investor unease with fiscal policy and the volume of upcoming bond issuance.

Credit spreads are also widening, signaling investor expectations for long-term inflation and a higher supply of long-duration bonds.

Visual – 10-Year vs 2-Year Treasury Yield Spread (10Y-2Y Spread)

Tax and Fiscal Policy

On May 22, the House narrowly passed the “One Big Beautiful Bill Act”, a sweeping fiscal package that includes new tax exemptions, defense and infrastructure spending, and the creation of “MAGA Savings Accounts” for families. While the bill is intended to bolster middle-income households and national security, markets are reacting to its estimated $3.8 trillion price tag and the corresponding $4 trillion increase to the debt ceiling.

Yields spiked in response to the bill’s passage, and risk assets briefly pulled back as investors reassessed long-term debt sustainability. Green energy stocks were notably impacted, as the bill slashes renewable subsidies outside of nuclear. Meanwhile, consumer staples and utilities sectors often favored during uncertain periods, outperformed, supported by their stable earnings and pricing power.

As the bill moves to the Senate ahead of the July 4 recess, we expect significant revisions, and we’re monitoring negotiations closely. Treasury officials have warned the U.S. could face another debt ceiling crunch as early as August 2025 if no resolution is reached.

Earnings and Sector Outlook: Strong, but Uncertain

On a positive note, over 75% of S&P 500 companies beat Q1 earnings estimates, reflecting broad strength in both tech and consumer staples. Companies with exposure to AI, semiconductors, and cloud services continue to deliver standout results. However, many have been reluctant to provide full-year guidance, citing uncertainty around rate policy, tax reform, and international supply chains.

BCap Stance on Market

At Benzor Capital Wealth, we approach the current environment with optimism grounded in strong corporate fundamentals and strategic agility. Earnings quality across most sectors has proven robust, highlighting the resilience and adaptability of businesses even in complex economic conditions. Our strategy continues to emphasize investing in companies with healthy balance sheets and demonstrated pricing power, positioning portfolios to capitalize on sustained growth.

We’re also maintaining targeted exposure to alternative assets, including real assets, private equity, and commodities, to capture potential outperformance during periods of macroeconomic shifts. Within fixed income, our preference remains for short-duration bonds, TIPS, and floating rate notes, aligning with a cautiously constructive outlook.

Looking ahead, we see substantial potential for positive market momentum through the remainder of 2025, particularly if policy uncertainties, especially around tariffs and taxes, are resolved favorably. A stable Federal Reserve stance combined with moderating inflation could further boost market confidence and investment returns.

We remain attentive to potential risks but are confident in our approach and the opportunities ahead. As always, thank you for your trust. Should you wish to review your portfolio or explore strategies tailored to your evolving goals, please connect with our team. We are committed to guiding your financial journey with clarity, care, and conviction.

Key Market Indices

*Market Indices as of 5/30/2025

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult a financial professional for your personal situation.

Past performance does not guarantee future results. Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Graphs provided by YCharts.

Key Market Indices according to Google Finance.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Vita Financial are not affiliated. The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this email in error, please reply to the sender to inform them of this fact. We cannot accept trade orders through email. Important letters, email, or fax messages should be confirmed by calling (678) 250-5099. This email service may not be monitored every day, or after normal business hours.