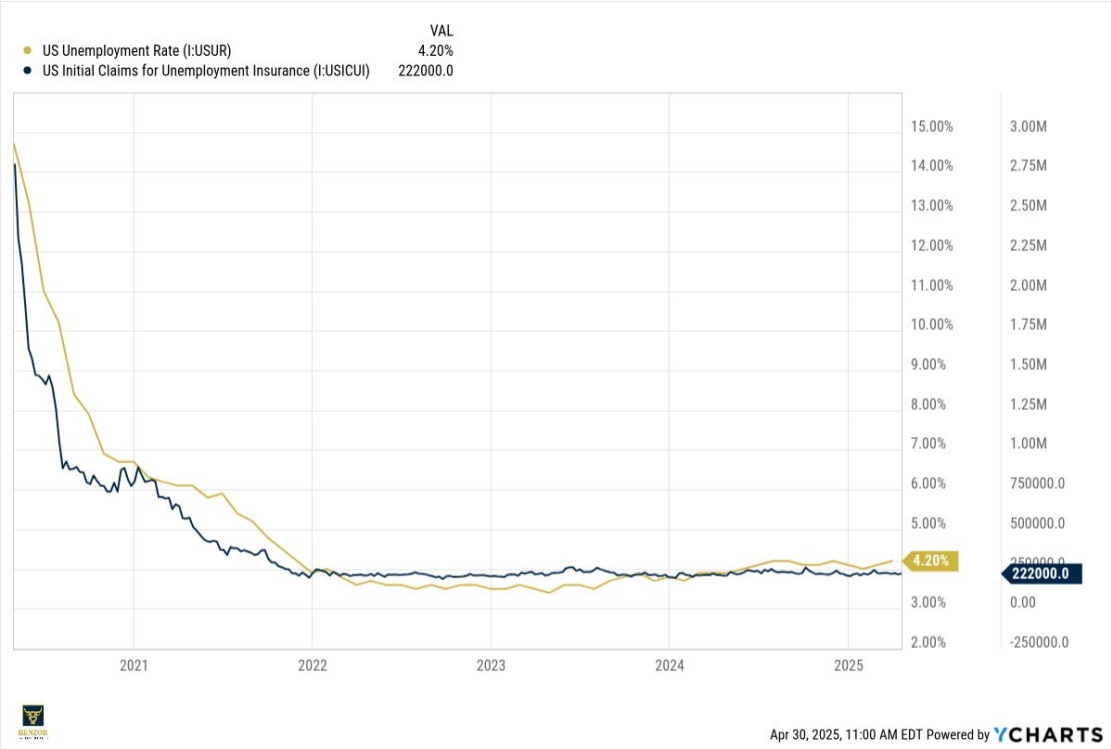

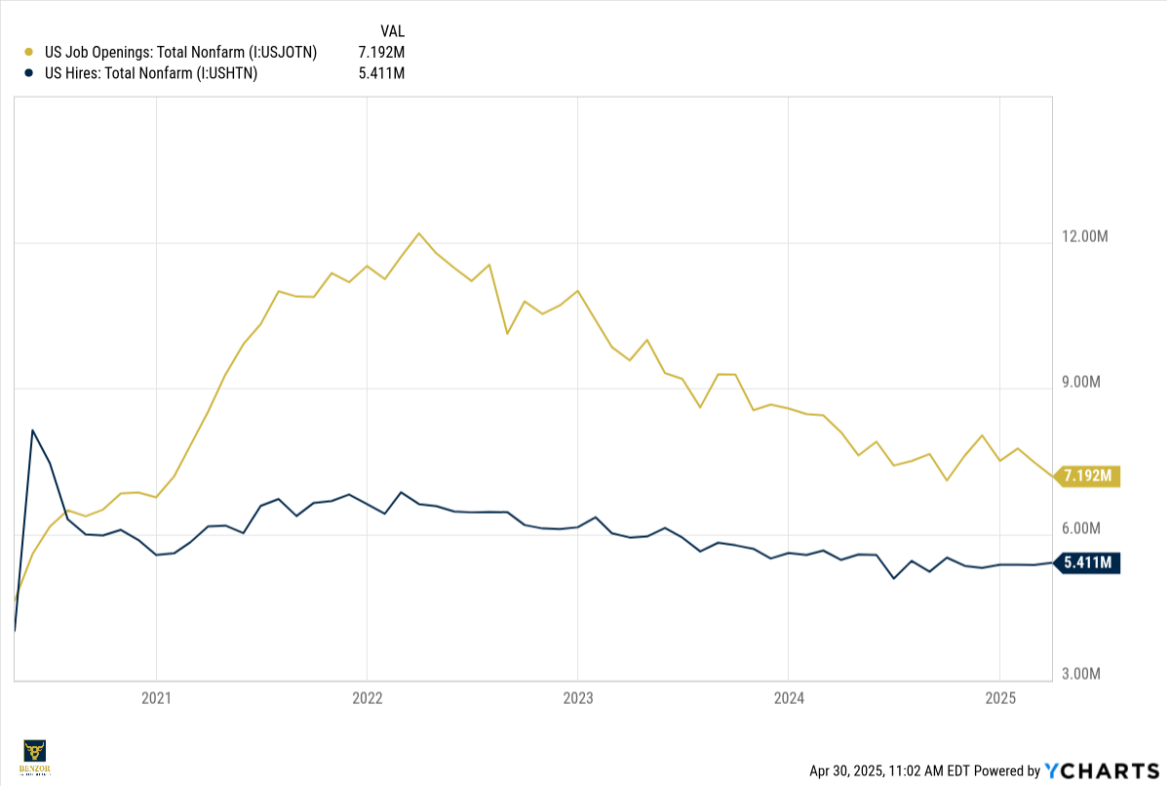

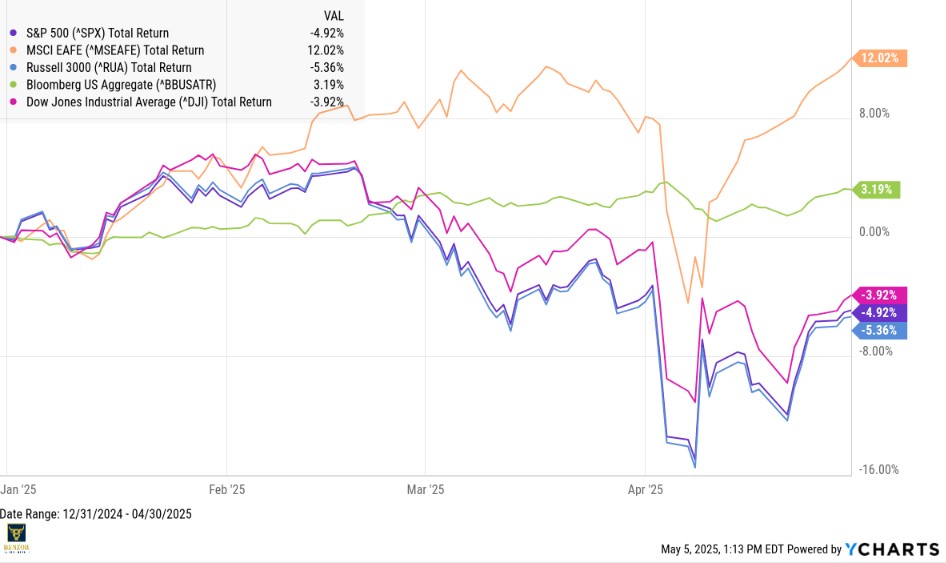

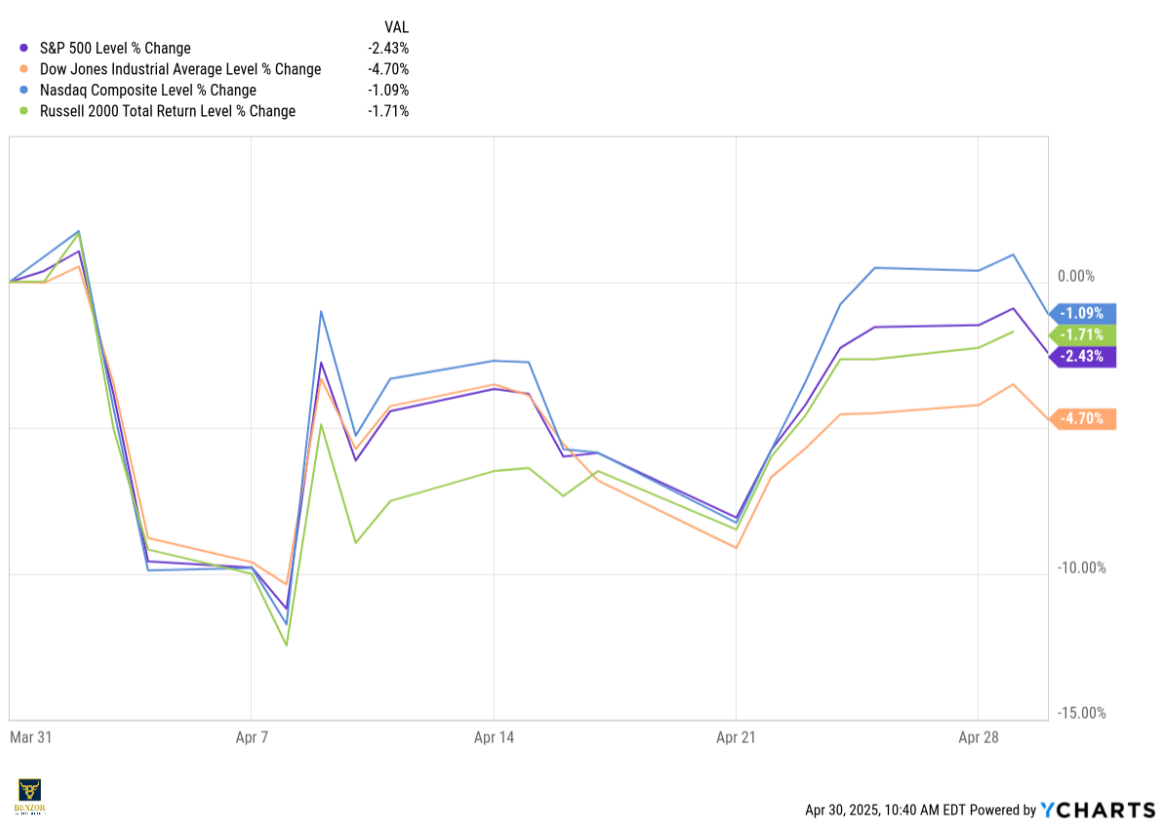

Markets have continued to experience heightened volatility largely due to uncertainty surrounding new tariff policies from the White House. As investors question how long these tariffs will remain in place — and whether they could contribute to broader economic pressures — it is important to stay informed and adaptable. One of the key risks on our radar is the potential for stagflation: the economic “worst-case scenario” combining high inflation, stagnant growth, and high unemployment. While the U.S. is not currently experiencing stagflation, the risk has materially increased compared to a year ago. Should growth continue to slow while inflation remains stubbornly high, stagflation-like conditions could emerge in late 2025 or early 2026. We are closely monitoring critical indicators such as persistent core inflation above 3%, GDP growth nearing or below zero, unemployment rising above 5%, and potential external shocks like geopolitical tensions.

to 4.1%. We will continue to assess labor market health as the April jobs report becomes available in early May. Today’s labor market data reveals a noticeable cooling in job growth, with April’s hiring pace decelerating more than expected across multiple sectors. While unemployment remains relatively low, the drop in new job creation signals a growing caution among employers amid ongoing economic uncertainty and tariff-related pressures. This softening in employment trends, alongside rising inflation, underscores the delicate balancing act the Federal Reserve faces as it weighs policy adjustments in the coming months. A sustained slowdown in job creation could act as a leading indicator of broader economic deceleration — further elevating stagflation risks and influencing asset allocation decisions across portfolios.

Technical Takes

From a technical perspective, markets are showing signs of weakening momentum. The S&P 500’s 50-day moving average is being tested, suggesting short-term caution, while the 200-day moving average remains a critical long-term support level. Indicators such as the Relative Strength Index (RSI) and MACD also point to a cooling in market momentum, and volume trends suggest growing caution among institutional investors. Key technical support and resistance levels for the S&P 500 (4950/4700 support; 5150/5200 resistance) and Dow Jones (38,000/37,000 support; 39,000/39,800 resistance) will be important to watch in the coming weeks.

Key Technical Levels:

Index Key Support Key Resistance

S&P 500 4950 / 4700 5150 / 5200

Dow Jones 38,000 / 37,000 39,000 / 39,800

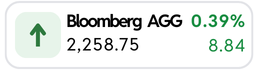

Bond Markets & Interest Rates

Turning to fixed income, the bond markets continue to reflect a higher-for-longer interest rate environment. The Fed is likely to find rate cuts difficult in the near term due to sticky inflation pressures. Treasury yields remain elevated, and credit markets are beginning to show greater caution. Spreads on investment-grade and high-yield bonds are widening, and defaults are creeping higher, particularly in sectors like commercial real estate and retail. Municipal bonds, however, remain resilient, offering attractive tax-advantaged income for high-net-worth investors. Investor flows have favored short-duration bonds and Treasury ETFs, reflecting caution around long-term interest rate volatility.

BCap Stance on Markets

At Benzor Capital Wealth, we remain cautious but not panicked. We view the current environment as one that demands strategic agility rather than wholesale risk avoidance. Diversification across alternative investments such as real assets, private equity, and commodities remains a central theme, particularly given the potential for stagflation. In equities, we continue to prioritize companies with strong balance sheets and pricing power. On the fixed income side, shorter-duration bonds, floating rate notes, and inflation protected securities (TIPS) are our preferred areas of focus. While the environment presents challenges, it also provides opportunities for well positioned portfolios. We are committed to navigating this landscape with a focus on resilience, flexibility, and our continued mission to deliver bespoke financial strategies tailored to your long-term goals. As always, if you have questions about your portfolio, upcoming opportunities, or want to schedule a review, please don’t hesitate to contact us. Together, we will continue building the path to financial freedom with clarity and confidence. Thank you for your continued trust in Benzor Capital Wealth.

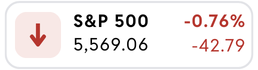

Key Market Indices

*Market Indices as of 4/30/2025

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult a financial professional for your personal situation.

Past performance does not guarantee future results. Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Graphs provided by YCharts.

Key Market Indices according to Google Finance.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Vita Financial are not affiliated. The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this email in error, please reply to the sender to inform them of this fact. We cannot accept trade orders through email. Important letters, email, or fax messages should be confirmed by calling (678) 250-5099. This email service may not be monitored every day, or after normal business hours.